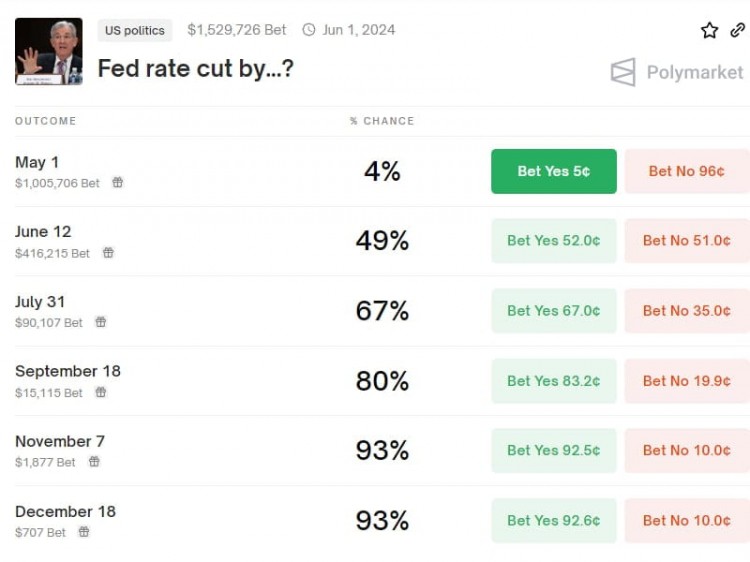

Bitcoin is currently trading at around $66,000, as the market grapples with rising Treasury yields and the potential delay of rate cuts by the Fed. Ether is trading above $3,300, while the broader market, as indicated by the CoinDesk 20 (CD20), is showing weakness. The recent surge in Treasury yields to a two-week high of 4.40% has led to a decrease in crypto futures rates and open interest, suggesting a potential end to a two-month rally. This has also resulted in a significant liquidation of long positions, with over $245 million in long positions and $60 million in BTC positions being liquidated in the last 24 hours. The uptick in Treasury yields has dampened investor appetite for risk, causing a shift in the market sentiment. Additionally, the CME Fed Watch tool is indicating a 97% chance of rates staying the same after May's meeting, further adding to the uncertainty in the market. Despite these challenges, the resilience of gold amid the weak tone in bitcoin and Wall Street's tech-heavy index, Nasdaq, reflects the complexity of the current market environment.摘要:Bitcoin{{BTC}}heldontolossesduringtheAsiantradinghoursonTuesday,tradingataround$66,000,astradersdigestedresurgentTreasuryyieldsandthepossibilitythattheFedmightdelayratecutsuntillaterthisyear...

Bitcoin Back Down to $66K As Rising Treasury Yield

版权声明:本站所有文章皆是来自互联网,如内容侵权可以联系我们删除!